Company Release – 11/09/2021

DENVER–(BUSINESS WIRE)– Apartment Investment and Management Company (“Aimco”) (NYSE: AIV) announced today third quarter results for 2021.

Wes Powell, Aimco President and Chief Executive Officer, comments: “The Aimco team is executing well across our various lines of business. Development and Redevelopment projects currently in lease-up are tracking ahead of plan, especially in South Florida where demand for luxury apartment homes continues to far outpace expectations. Despite supply chain pressures and rising costs, Aimco projects which are under construction remain on-time and on-budget thanks to our disciplined process and proactive management. All the while, the Aimco investment pipeline continues to expand and top-line growth within our stabilized operating portfolio is accelerating. These solid results are a testament to the Aimco platform.”

Financial Results and Recent Highlights

- Net loss attributable to common stockholders per share, on a dilutive basis, was $(0.03) for the quarter ended September 30, 2021, compared to net income per share of $0.01 for the same period in 2020, due primarily to differences from the carve-out of Aimco predecessor prior year expenses.

- Aimco Total Shareholder Return was 43.6% year-to-date through October 2021.

- Strong demand for Aimco’s Development and Redevelopment projects resulted in the execution of approximately 150 net new leases during the period, at rental rates ahead of target, and contributed $3.2 million in revenue during the period, up nearly 30% from the second quarter.

- Aimco has re-opened Flamingo Point’s North Tower, welcoming new residents to the fully renovated waterfront community during the third quarter as planned.

- Aimco acquired, for $40 million, a collection of 58 luxury townhomes in Elmhurst, Illinois, and benefits from the community’s adjacency to an existing Aimco asset.

- Aimco closed $60 million of property financing and ended the third quarter with $413 million of liquidity, including cash and capacity on its revolving credit facility.

- Revenue from Aimco’s Operating Properties was up 3.8% from the second quarter and 6.9% year-over-year, with occupancy of 97.8%, up 280 basis points year-over-year.

Value Add, Opportunistic & Alternative Investments:

Development and Redevelopment

Aimco generally seeks development and redevelopment opportunities where barriers to entry are high, target customers can be clearly defined, and where Aimco has a comparative advantage over others in the market. Aimco’s Value Add and Opportunistic investments may also target portfolio acquisitions, operational turnarounds, and re-entitlements.

In the third quarter, Aimco had eight active development and redevelopment projects located in five different markets across the United States. These projects remain on track, as evidenced by project-level budget and schedule, lease-up metrics, and current market valuations.In the third quarter, Aimco invested approximately $42 million at these projects and expects to invest another $374 million at properties currently in development and redevelopment.

- At the North Tower of Flamingo Point in Miami Beach, Florida, the delivery and occupancy of apartment homes began in the third quarter as planned. Demand has been strong with the property more than 50% leased or preleased, six months prior to final completion, at rental rates approximately 25% ahead of underwriting.

- At 707 Leahy in Redwood City, California, stabilized occupancy was achieved during the third quarter slightly earlier than planned, with the property 97% leased on September 30, 2021, at rates meeting underwritten expectations.

- At Prism in Cambridge, Massachusetts, construction was completed during the first quarter of 2021 and on September 30, 2021, the property was 88% occupied at rents trending in line with our underwritten targets.

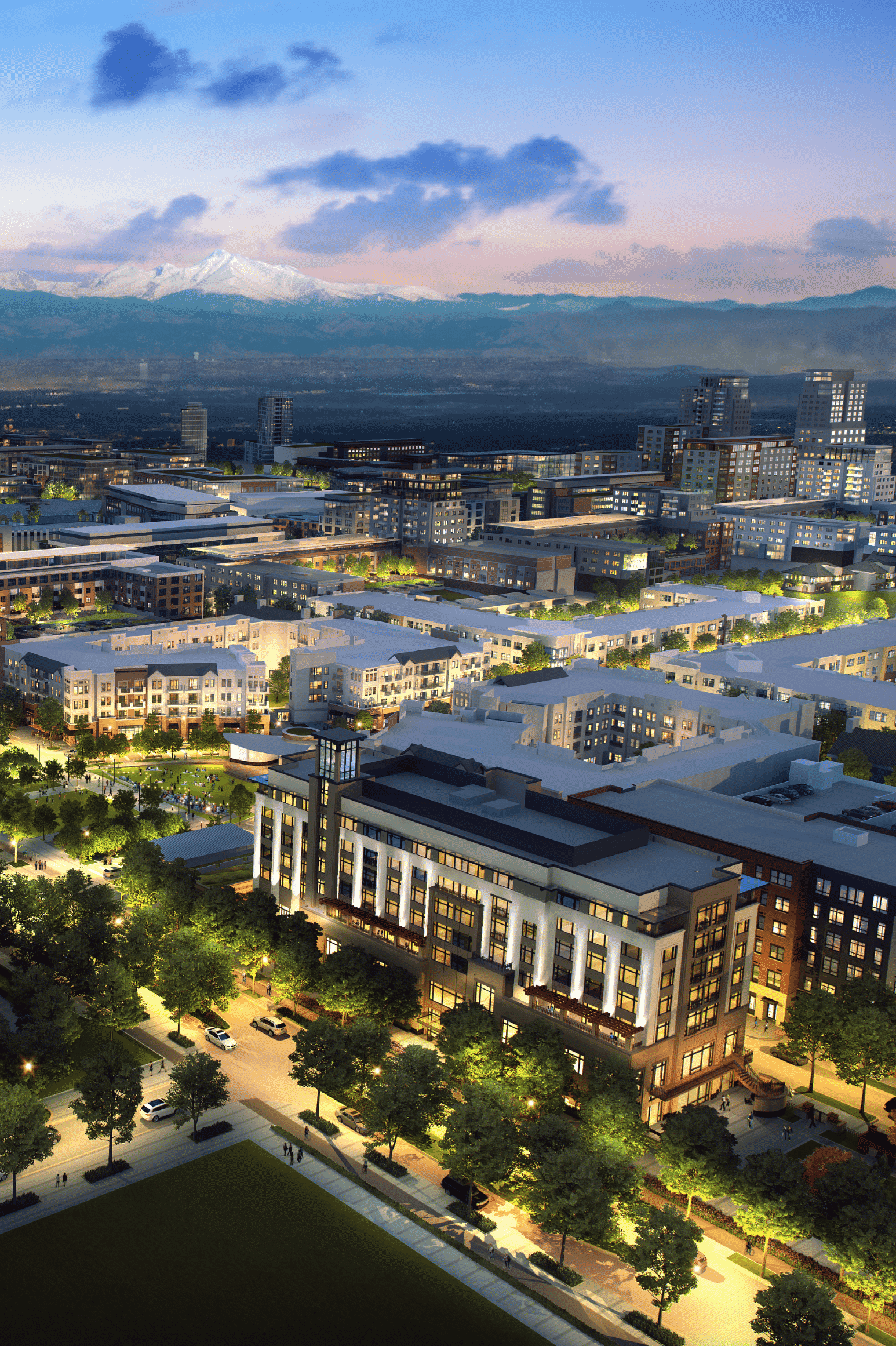

- Construction continues on schedule and on budget at The Benson Hotel and Faculty Club in Aurora, Colorado, Hamilton on the Bay in Miami, Florida and Oak Shore (fka. Robin Drive Land) in Corte Madera, California.

Alternative Investments

Aimco uses alternative investment strategies when it has special knowledge or expertise relevant to the venture and when opportunity exists for positive asymmetric outcomes. Aimco’s current investments include a mezzanine loan with an option to participate in future development and two passive equity investments.

- In the third quarter, Aimco funded a capital call of $12.1 million associated with the previously announced $50 million total passive equity commitment to the life sciences developer, IQHQ, bringing our total investment to $24.6 million.

- The outstanding balance on Aimco’s mezzanine loan to the partnership that owns Parkmerced Apartments was $330 million, including accrued interest, at the end of the third quarter. Property operations remain consistent with previous reports.

Investment Activity

Aimco expects to have a broad set of investment opportunities including, but not limited to, development, redevelopment, portfolio acquisitions, programmatic joint ventures, debt placements, operational turnarounds, and re-entitlements. During the third quarter:

- Aimco acquired, for $40 million, Eldridge Townhomes, a 58-unit townhome community located in Elmhurst, Illinois that Aimco developed between 2018 and 2020. As of September 30, 2021, the property was 98% occupied with average rents of greater than $4,000 per month. The Eldridge Townhomes are located adjacent to an existing 400-unit Aimco community and the acquisition provides for continued operational efficiencies and improved NOI margins. Aimco plans to hold the Eldridge Townhomes within its portfolio of stabilized operating properties.

- Aimco acquired two properties adjacent to its Hamilton on the Bay apartment community in Miami’s Edgewater neighborhood, for $7 million. Combined with the six properties purchased in the second quarter and land purchased as part of the initial acquisition of Hamilton on the Bay, Aimco can, in total, now construct more than 1.1M square feet of new development in this rapidly growing submarket.

- Aimco entered into a joint venture with Kushner Companies to purchase three undeveloped land parcels located in downtown Fort Lauderdale, Florida. The total contract price for the land is $49 million ($25 million at Aimco’s 51% share), and current zoning allows for the development of approximately three million square feet of multifamily homes and commercial space. The land purchase is expected to close in January 2022.

- Aimco purchased seven acres of developable land in Colorado Springs, Colorado with a contract price of $4 million that allows for the construction of 119 apartment homes and townhomes.

Operating Property Results

Aimco’s Operating Portfolio produced solid results for the quarter ended September 30, 2021, showing continued improvement as our business recovers from the pandemic related impacts of 2020.

| Third Quarter | Year-to-Date | ||||||||||||||||||||||||||||||

| Year-over-Year | Sequential | Year-over-Year | |||||||||||||||||||||||||||||

| ($ in millions) | 2021 | 2020 | Variance | 2Q 2021 | Variance | 2021 | 2020 | Variance | |||||||||||||||||||||||

| Average Daily Occupancy | 97.8 | % | 95.0 | % | 2.8 | % | 97.3 | % | 0.5 | % | 97.6 | % | 96.2 | % | 1.4 | % | |||||||||||||||

| Revenue, before utility reimbursements | $ | 34.6 | $ | 32.4 | 6.9 | % | $ | 33.3 | 3.8 | % | $ | 100.6 | $ | 98.3 | 2.3 | % | |||||||||||||||

| Expenses, net of utility reimbursements [1] | 11.2 | 10.2 | 10.6 | % | 11.0 | 2.7 | % | 33.4 | 31.1 | 7.4 | % | ||||||||||||||||||||

| Net operating income (NOI)[2] | 23.3 | 22.2 | 5.1 | % | 22.4 | 4.3 | % | 67.2 | 67.2 | — |

*Excluded from the table above is one, 40-unit apartment community that Aimco’s ownership includes a partnership share.

[1] The year over year increase in expenses, net of utility reimbursements is due primarily to higher real estate taxes and insurance.

[2] See “Glossary and Reconciliations of Non-GAAP Financial and Operating Measures” for a reconciliation of this measure.

- In the third quarter, Aimco collected 98.2% of all amounts owed by residents and recognized 99.2% of contractual revenue, reserving 80 basis points as bad debt.

- 1001 Brickell Bay Drive, a waterfront office building in Miami, Florida, is owned as part of a larger assemblage containing substantial excess development rights. At the end of the third quarter, the building was 73% occupied, and as of October 31, 2021, the building was 80% leased with additional leases being negotiated. Through October 31, 2021, 99% of third quarter rents due have been collected.

Balance Sheet and Financing Activity

Aimco is highly focused on maintaining ample liquidity. As of September 30, 2021, Aimco had access to $413 million, including $253 million of cash on hand, $10 million of restricted cash, and the capacity to borrow up to $150 million on our revolving credit facility.

Aimco’s net leverage as of September 30, 2021 was as follows:

| as of September 30, 2021 | ||||||||

| Proportionate, $ in thousands | Amount | Weighted Avg.Maturity (Yrs.) | ||||||

| Total non-recourse property debt | $ | 493,958 | 5.7 | |||||

| Total non-recourse construction loan debt | 142,974 | 2.6 | ||||||

| Notes payable to AIR | 534,127 | 2.3 | ||||||

| Cash and restricted cash | (262,760 | ) | ||||||

| Net Leverage | $ | 908,299 |

- In the third quarter, Aimco closed two non-recourse property loans with proceeds of $60 million. The loans have 10-year terms and a weighted average fixed interest rate of 3.09%. Proceeds from the loans were used to fund the acquisition of Eldridge Townhomes and other investment activity.

Dividend

Aimco plans to reinvest earnings to facilitate growth and, therefore, does not presently intend to pay a regular cash dividend.

Supplemental Information

The full text of this Earnings Release and the Supplemental Information referenced in this release are available on Aimco’s website at investors.aimco.com.

Glossary & Reconciliations of Non-GAAP Financial and Operating Measures

Financial and operating measures found in this Earnings Release and the Supplemental Information include certain financial measures used by Aimco management that are measures not defined under accounting principles generally accepted in the United States, or GAAP. Certain Aimco terms and Non-GAAP measures are defined in the Glossary in the Supplemental Information and Non-GAAP measures reconciled to the most comparable GAAP measures.

About Aimco

Aimco is a diversified real estate company primarily focused on value add, opportunistic, and alternative investments, targeting the U.S. multifamily sector. Aimco’s mission is to make real estate investments where outcomes are enhanced through our human capital so that substantial value is created for investors, teammates, and the communities in which we operate. Aimco is traded on the New York Stock Exchange as AIV. For more information about Aimco, please visit our website www.aimco.com.

Team and Culture

Aimco has a national presence with corporate headquarters in Denver, Colorado, and Bethesda, Maryland. Our investment platform is managed by experienced real estate professionals based in four regions of the United States: West Coast, Central and Mountain West, Mid-Atlantic and Northeast, and Southeast. The experience and in-depth local market knowledge of the Aimco team is essential to the execution of our mission and realization of our vision.

Above all else, Aimco is committed to a culture of integrity, respect, and collaboration.

Forward-Looking Statements

This document contains forward-looking statements within the meaning of the federal securities laws. Forward-looking statements include all statements that are not historical statements of fact and those regarding our intent, belief, or expectations. We caution investors not to place undue reliance on any such forward-looking statements.

Words such as “anticipate(s),” “expect(s),” “intend(s),” “plan(s),” “believe(s),” “may,” “will,” “would,” “could,” “should,” “seek(s)” and similar expressions, or the negative of these terms, are intended to identify such forward-looking statements. These statements are based on management’s current expectations and beliefs and are subject to a number of risks and uncertainties that could lead to actual results differing materially from those projected, forecasted or expected. Although we believe that the assumptions underlying the forward-looking statements are reasonable, we can give no assurance that our expectations will be attained.

Readers should carefully review Aimco’s financial statements and the notes thereto, as well as the section entitled “Risk Factors” in Item 1A of Aimco’s Annual Report on Form 10-K for the year ended December 31, 2020, and subsequent Quarterly Reports on Form 10-Q and other documents Aimco files from time to time with the SEC. These filings identify and address important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements.

These forward-looking statements reflect management’s judgment as of this date, and Aimco assumes no (and disclaims any) obligation to revise or update them to reflect future events or circumstances.

Consolidated Statements of Operations

(in thousands, except per share data) (unaudited)

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||

| 2021 | 2020 | 2021 | 2020 | |||||||||||||

| REVENUES: | ||||||||||||||||

| Rental and other property revenues | $ | 42,893 | $ | 37,328 | $ | 123,115 | $ | 112,802 | ||||||||

| OPERATING EXPENSES: | ||||||||||||||||

| Property operating expenses | 18,155 | 15,151 | 51,500 | 45,822 | ||||||||||||

| Depreciation and amortization | 21,709 | 19,296 | 63,065 | 57,673 | ||||||||||||

| General and administrative expenses [1] | 8,868 | 1,552 | 22,562 | 4,939 | ||||||||||||

| Total operating expenses | 48,732 | 35,999 | 137,127 | 108,434 | ||||||||||||

| Interest expense | (12,680 | ) | (7,103 | ) | (37,995 | ) | (18,563 | ) | ||||||||

| Mezzanine investment income, net | 7,636 | 6,870 | 22,654 | 20,553 | ||||||||||||

| Unrealized gains (losses) on interest rate options [2] | 2,231 | (998 | ) | 10,608 | (2,078 | ) | ||||||||||

| Other expenses, net | 1,785 | (775 | ) | 5,066 | (1,344 | ) | ||||||||||

| (Loss) income before income taxes | (6,867 | ) | (677 | ) | (13,679 | ) | 2,936 | |||||||||

| Income tax benefit (expense) | 2,021 | 2,673 | 9,881 | 6,728 | ||||||||||||

| Net (loss) income | (4,846 | ) | 1,996 | (3,798 | ) | 9,664 | ||||||||||

| Net income attributable to redeemable noncontrolling interests in consolidated real estate partnership | (127 | ) | 121 | (41 | ) | 349 | ||||||||||

| Net loss (income) attributable to noncontrolling interests in consolidated real estate partnership | (296 | ) | 1 | (862 | ) | (4 | ) | |||||||||

| Net loss (income) attributable to common noncontrolling interests in Aimco Operating Partnership | 253 | (107 | ) | 209 | (507 | ) | ||||||||||

| Net (loss) income attributable to Aimco commonstockholders | $ | (5,016 | ) | $ | 2,011 | $ | (4,492 | ) | $ | 9,502 | ||||||

| Net (loss) income attributable to common stockholders per share – basic | $ | (0.03 | ) | $ | 0.01 | $ | (0.03 | ) | $ | 0.06 | ||||||

| Net (loss) income attributable to common stockholders per share – diluted | $ | (0.03 | ) | $ | 0.01 | $ | (0.03 | ) | $ | 0.06 | ||||||

| Weighted-average common shares outstanding – basic | 149,762 | 148,549 | 149,517 | 148,549 | ||||||||||||

| Weighted-average common shares outstanding – diluted | 149,762 | 148,569 | 149,517 | 148,569 |

[1] General and administrative expense in the three and nine months ended September 30, 2020 are represented as a carve-out of Aimco predecessor expenses and are not representative of Aimco’s anticipated expenses.

[2] Unrealized gains (losses) on interest rate options are primarily the quarterly market-to-market adjustment required to mark to fair value Aimco’s interest rate options.

Consolidated Balance Sheets

(in thousands) (unaudited)

| September 30, | December 31, | |||||||

| 2021 | 2020 | |||||||

| Assets | ||||||||

| Buildings and improvements | $ | 1,202,279 | $ | 995,116 | ||||

| Land | 534,092 | 505,153 | ||||||

| Total real estate | 1,736,371 | 1,500,269 | ||||||

| Accumulated depreciation | (545,499 | ) | (495,010 | ) | ||||

| Net real estate | 1,190,872 | 1,005,259 | ||||||

| Cash and cash equivalents | 253,138 | 289,582 | ||||||

| Restricted cash | 9,623 | 9,153 | ||||||

| Mezzanine investments | 330,016 | 307,362 | ||||||

| Right-of-use lease assets | 439,229 | 98,280 | ||||||

| Other assets, net | 171,317 | 130,856 | ||||||

| Total assets | $ | 2,394,195 | $ | 1,840,492 | ||||

| Liabilities and Equity | ||||||||

| Non-recourse property debt, net | $ | 485,116 | $ | 447,967 | ||||

| Construction loans, net | 138,439 | — | ||||||

| Notes payable to AIR | 534,127 | 534,127 | ||||||

| Total indebtedness | 1,157,682 | 982,094 | ||||||

| Deferred tax liabilities | 126,851 | 131,560 | ||||||

| Lease liabilities | 448,886 | 100,496 | ||||||

| Accrued liabilities and other | 95,943 | 62,988 | ||||||

| Total liabilities | 1,829,362 | 1,277,138 | ||||||

| Redeemable noncontrolling interests in consolidated real estate partnership | 4,304 | 4,263 | ||||||

| Equity: | ||||||||

| Common Stock | 1,498 | 1,490 | ||||||

| Additional paid-in capital | 518,913 | 515,127 | ||||||

| Retained earnings (accumulated deficit) | (21,377 | ) | (16,839 | ) | ||||

| Total Aimco equity | 499,034 | 499,778 | ||||||

| Noncontrolling interests in consolidated real estate partnerships | 35,014 | 31,877 | ||||||

| Common noncontrolling interests in Aimco Operating Partnership | 26,481 | 27,436 | ||||||

| Total equity | 560,529 | 559,091 | ||||||

| Total liabilities and equity | $ | 2,394,195 | $ | 1,840,492 |

View source version on businesswire.com: https://www.businesswire.com/news/home/20211109006572/en/

Matt Foster, Director, Capital Markets and Investor Relations

Investor Relations 303-793-4661, [email protected]

Source: Apartment Investment and Management Company